Map Rule Mortgage – After all, you don’t want to end up “house poor,” paying so much for your mortgage that you have little left over for other expenses and savings. That’s where the “25% rule of thumb” can be a . Raising a second mortgage on a house will become harder after the City watchdog said it would subject the niche product to more stringent rules, brokers have warned. The Financial Conduct Authority .

Map Rule Mortgage

Source : safeexamtraining.com

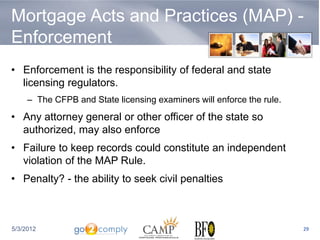

MAPs Staying Compliant in Mortgage Advertising | PPT

Source : www.slideshare.net

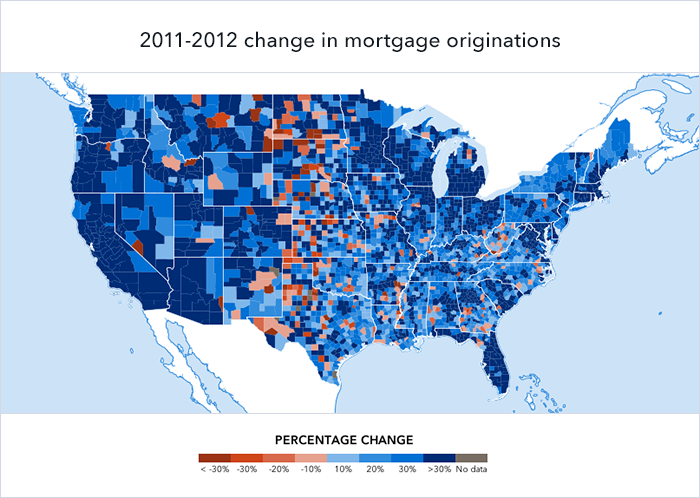

Our new mortgage visualization tool | Consumer Financial

Source : www.consumerfinance.gov

MAPs Staying Compliant in Mortgage Advertising | PPT

Source : www.slideshare.net

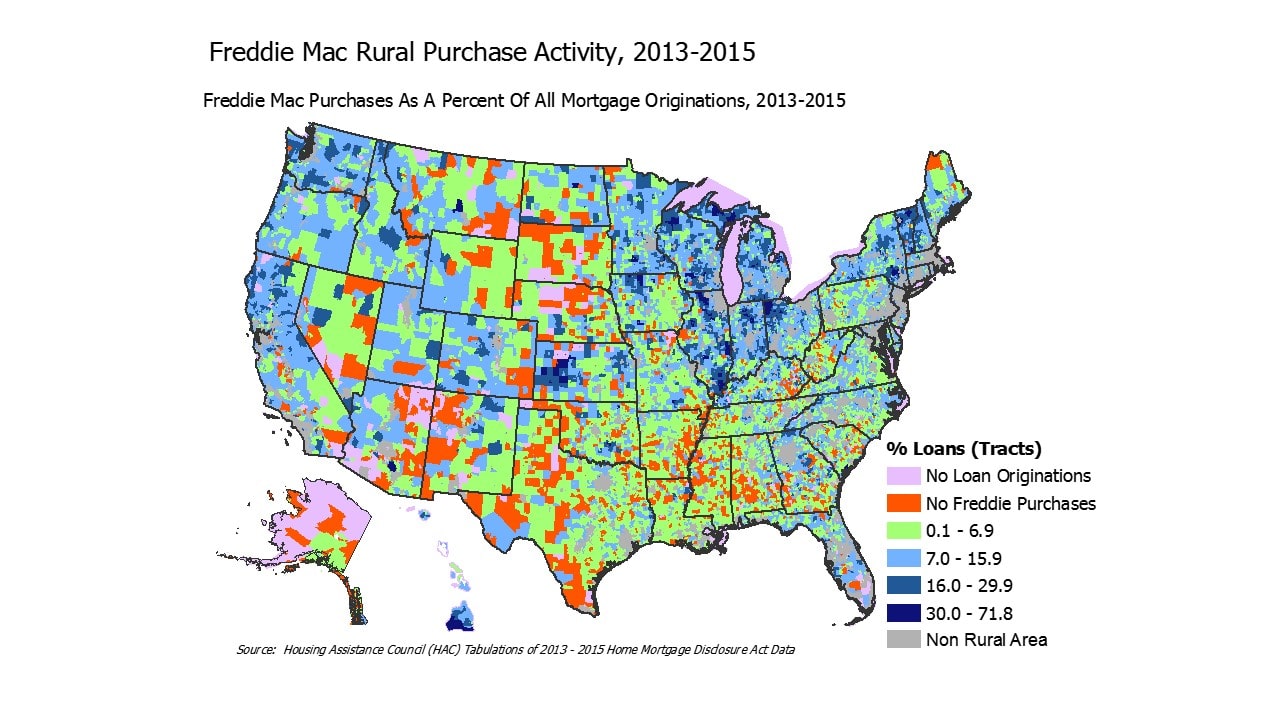

FHFA Publishes Fannie Mae’s and Freddie Mac’s Duty to Serve

Source : ruralhome.org

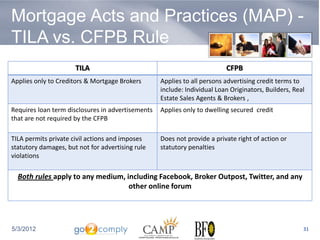

MAPs Staying Compliant in Mortgage Advertising | PPT

Source : www.slideshare.net

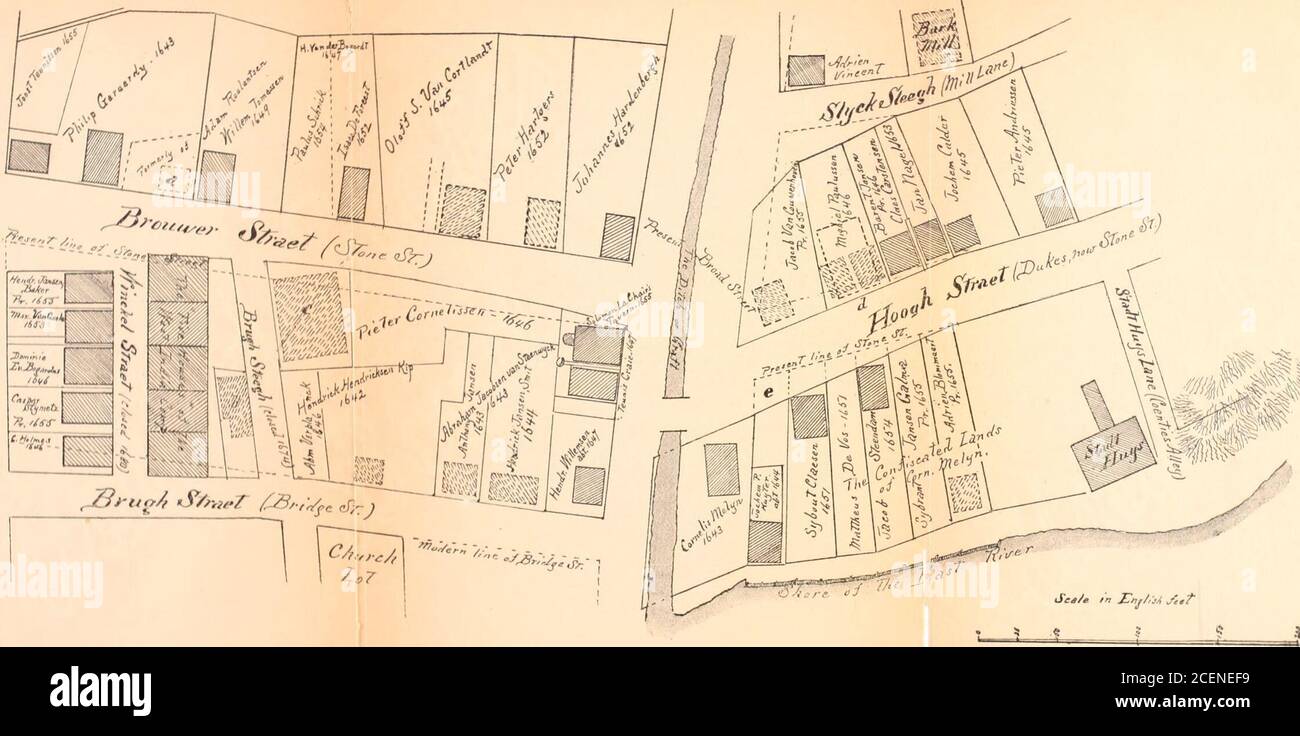

New Amsterdam and its people; studies, social and topographical

Source : www.alamy.com

MAPs Staying Compliant in Mortgage Advertising | PPT

Source : www.slideshare.net

1st Loan Advisor Rules of Money

Source : www.facebook.com

MAPs Staying Compliant in Mortgage Advertising | PPT

Source : www.slideshare.net

Map Rule Mortgage The Mortgage Acts and Practices Rule (MAP) NMLS Mortgage : Your monthly mortgage payment will probably be the largest line item in your household budget. Impacting the size of those payments is the sort of mortgage you choose — particularly a 15-year vs. . New mortgage rules from the federal government are now in effect. As of Aug. 1, first-time buyers purchasing newly-built homes will now have 30 years to pay off an insured mortgage instead of 25 .